The trial court approved transfer of structured settlement payments to a factoring company and ordered the payor insurance company to send the funds directly to the factor, and the insurance company appealed. The Structured Settlement Protection Act [SSPA; Insurance Code section 10134 et seq.] was passed to protect structured settlement payees from exploitation by factoring […]

Payback To Insurance Company After It’s Ordered To Pay Cumis Counsel To Defend Its Insured, And It Claims Cumis Counsel Padded The Bills.

The question tackled by the California Supreme Court here is that after an insurance company is compelled by a court order to provide independent counsel to defend its insured in a third-party action pursuant to San Diego Federal Credit Union v. Cumis Ins. Society, Inc. (1984) 162 Cal.App.3d 358 [208 Cal.Rptr. 494], and the insurer […]

Insurer Not Obligated To Defend Or Indemnify In Light Of Intellectual Property Exclusion.

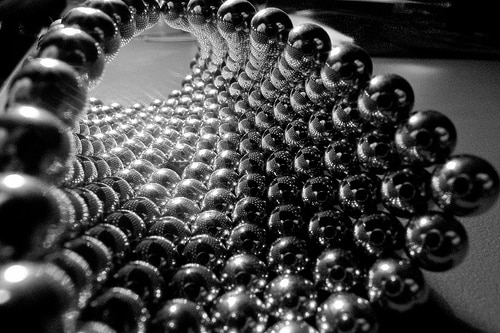

A famous inventor’s estate alleged the commercial use of the inventor’s name was not authorized after defendant manufactured and distributed several products using the name Buckyball, allegedly without permission or payment. Defendant tendered defense of the action to its insurance company. The insurance company agreed to defend under a reservation of rights and Cumis counsel […]

Insurance Company Waived Right To Rescind Policy.

Five days after treatment at a breast center for a lump on her breast which proved to be cancerous as she continued her treatment, plaintiff applied for medical insurance. The questions on the application included whether she had “received any professional advice or treatment . . . from a licensed health practitioner” or “had any […]

Summary Judgment Reversed Because There Is A Potential For Coverage Under Umbrella Policy.

When she was 17 years old, plaintiff was invited to a party by several members of a college baseball team. She claims that upon her arrival, she was given shots of hard liquor in quick succession, and later was assaulted by an unknown number of men as she lay unconscious in a room. Three women […]

No Coverage For Frozen Ground Beef.

After a food company’s frozen ground beef was ordered recalled by the Department of Agriculture [USDA], the food company made a claim under its Contamination Products Insurance policy issued by defendant insurers. Coverage was denied on various grounds, and the food company sued for breach of contract and bad faith. Finding no triable issues of […]

After Partial Payment In Medical Malpractice Action, Patient Was Not Informed Of Statute Of Limitations.

After surgery, a patient suffered an infection. The bacteria that infected the patient’s knee apparently survived the sterilization process at the surgical facility. The bacteria was found on a surgical sponge. The doctor paid the patient $4,118.23 for the medical expenses he incurred for treatment of the infection. Fifteen months later, the patient sued the […]

The Cost At A Hospital Is Different For You.

A man with no medical insurance signed an agreement to pay a hospital’s full charges when he received emergency care at a hospital. He later filed a consumer class action asserting claims under Business and Professions Code section 17200 and Civil Code section 1750. His complaint alleges the hospital “failed to disclose uninsured patients would […]

Insured Entitled To Conditional Judgment Against Insurance Company.

Three days after an insurance company issued a property policy, burglars caused serious damage to the building by stripping all electrical and other conductive materials. The policy provided two different measures for reimbursing covered damages: the full cost of repairing the damages, so long the repairs were actually made, or the depreciated value of the […]

Read The Policy.

The intoxicated driver who caused the accident which killed a man had insurance coverage of $15,000. The intoxicated driver’s employer had $250,000 coverage. The decedent’s widow collected that $265,000 in a settlement. Thereafter, the widow sought to collect $100,000 in underinsured motorist coverage under a motorcycle insurance policy issued to the decedent and the widow. […]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 10

- Next Page »